This blog post provides a comprehensive guide on how to get liability insurance, emphasizing the significance of having adequate coverage. It explores how to choose the right liability insurance by evaluating various types available and understanding their specific benefits. Additionally, the article delves into the costs associated with liability insurance, helping readers budget effectively. To ensure smart management of their policies, the post includes actionable tips that readers can implement. Overall, this resource aims to equip individuals and businesses with the knowledge necessary to navigate the complexities of liability insurance and make informed decisions.

Understanding The Importance Of Liability Insurance

Contents

When considering how to protect your personal and business assets, understanding how to secure liability insurance is crucial. Liability insurance serves as a safety net, shielding you from unforeseen incidents that could lead to significant financial loss. The right policy can cover legal fees, medical expenses, and settlements resulting from lawsuits, making it an indispensable component in modern insurance planning.

Identifying your specific needs is the first step in understanding how to obtain liability insurance. Different types of coverage exist, catering to a variety of scenarios, whether for professional services or personal situations. It’s vital to assess your risks and consult with a trusted insurance provider to tailor a policy that aligns with your individual or business requirements.

| Type of Liability Insurance | Who Needs It? | Key Features |

|---|---|---|

| General Liability Insurance | Businesses | Covers third-party bodily injury and property damage |

| Professional Liability Insurance | Consultants, Lawyers, Accountants | Covers errors and omissions in professional services |

| Product Liability Insurance | Manufacturers, Retailers | Covers damages from defective products |

| Public Liability Insurance | Events, Public Gatherings | Covers injuries to the public at your events |

Once you’ve examined your risks, you can narrow down your options. Understanding how to compare policies based on coverage limits, exclusions, and premiums is essential. Be sure to ask your insurance agent specific questions regarding each option to avoid any surprises down the line. Here’s a useful checklist to guide you:

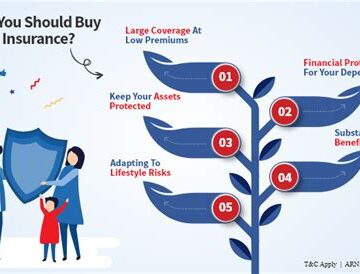

- Key Reasons To Have Liability Insurance

- Protection against unexpected lawsuits.

- Covers legal fees and settlement costs.

- Provides peace of mind for personal and professional activities.

- Enhances credibility with clients or partners.

- Makes compliance with business regulations easier.

- Safeguards personal assets against claims.

Ultimately, grasping the importance of liability insurance equips you with the knowledge of how to secure financial stability against potential risks. By assessing your needs, consulting with professionals, and comparing various policies, you can make informed decisions that protect your future. Taking proactive steps now can save you from costly repercussions later, ensuring that you are well-prepared for any eventualities.

How To Choose The Right Liability Insurance Coverage

When deciding on the best liability insurance coverage, it’s crucial to assess your specific needs. Choosing the right policy can protect you from significant financial loss and legal repercussions. To start effectively, you should familiarize yourself with various coverage options available in the market. Liability insurance is not a one-size-fits-all solution; it varies based on your circumstances. Therefore, understanding your business activities and potential exposure is essential.

One way to make an informed choice is by comparing different liability insurance plans. It’s important to evaluate not just the cost but also the comprehensiveness of coverage offered by each policy. You should check for exclusions that may leave you vulnerable, ensuring that you are not blindsided by any limitations when making a claim. A thorough examination will help you decipher which policy aligns best with your unique requirements.

| Insurance Type | Coverage Description | Typical Costs |

|---|---|---|

| General Liability | Covers common risks like property damage and bodily injury. | $500 – $3,000 annually |

| Professional Liability | Offers protection against claims of negligence or mistakes in professional services. | $1,000 – $5,000 annually |

| Product Liability | Protects against claims related to product defects and damages. | $1,200 – $6,000 annually |

| Workers’ Compensation | Required for most businesses, covers employee injuries and illnesses. | $2,000 – $10,000 annually |

After assessing your options, the next critical step is to understand the policy limits. Limitations dictate the maximum amount the insurer will pay in case of a claim. Recognizing these limits is important, as lacking adequate coverage could mean facing substantial out-of-pocket expenses should an incident arise. Ensure you choose limits that align with your risk exposure and financial reality, safeguarding you from potentially damaging liabilities.

Evaluating Coverage Options

Once you understand the policy limits, evaluating coverage options becomes vital. This evaluation should take into account your industry, the size of your business, and your risk profile. Different sectors often require tailored coverage due to their unique liabilities. Learn what other businesses in your field are doing regarding liability coverage; peer insights can provide valuable perspectives.

Understanding Policy Limits

As emphasized earlier, understanding your policy limits is paramount to a sound insurance strategy. Take time to read through the terms and conditions, looking out for specific exclusions that might impact your protection. Engaging with an insurance agent or broker can also offer clarity, as they can help navigate complex insurance jargon and ensure that you’re adequately covered.

Steps To Evaluate Your Options

- Identify the specific risks associated with your business.

- Research different types of liability insurance available.

- Compare coverage options and certain exclusions.

- Assess the policy limits in relation to your specific needs.

- Consult with an insurance expert for personalized advice.

- Review customer feedback and ratings on insurers.

- Make an informed decision based on your research and needs.

Exploring The Different Types Of Liability Insurance

Understanding the various types of liability insurance is crucial for individuals and businesses looking to protect themselves from potential legal claims. Liability insurance serves as a financial safety net, mitigating risks associated with unforeseen incidents. In essence, it covers the costs of legal defense, settlements, and judgments, ensuring that your financial assets are safeguarded. Whether you are a contractor, a business owner, or a homeowner, having the right coverage can make all the difference in times of need.

One of the most common questions is how to identify which type of liability insurance is appropriate for your situation. Different scenarios call for different insurance types, and making the right choice can protect you from various liabilities. For instance, personal liability insurance is important for homeowners, while professional liability insurance is critical for service providers. It is essential to assess your needs to connect with the appropriate coverage.

| Type of Liability Insurance | Description | Best For |

|---|---|---|

| General Liability Insurance | Covers bodily injury and property damage. | Businesses and contractors |

| Professional Liability Insurance | Protects against claims of negligence and malpractice. | Professionals like doctors and lawyers |

| Product Liability Insurance | Covers claims related to product defects. | Manufacturers and retailers |

| Employer’s Liability Insurance | Protects against employee claims for work-related injuries. | Employers |

As you explore your options, it’s vital to familiarize yourself with the common types of liability insurance. Here are some of the most prevalent options available:

- General Liability Insurance

- Professional Liability Insurance

- Product Liability Insurance

- Employer’s Liability Insurance

- Commercial Auto Insurance

- Cyber Liability Insurance

Deciding on the right policy can feel overwhelming, but understanding the different types of liability insurance can simplify your decision-making process. It’s important to evaluate your specific risks and consult with an insurance professional who can guide you through selecting the coverage that best fits your needs. Remember, the right insurance policy not only provides peace of mind but also protects your future from unexpected legal challenges.

Evaluating The Costs Associated With Liability Insurance

When considering how to evaluate the costs of liability insurance, it’s essential to understand that various factors can significantly influence the premiums you will pay. These costs can vary widely depending on the nature of your business and the specific coverage options you choose. A deep understanding of these costs will help you select a policy that offers adequate coverage without overextending your budget.

One key aspect to evaluate is the premiums related to the level of coverage you require. Higher limits generally result in higher premiums, but they offer greater protection in the event of a claim. Additionally, the frequency of claims in your industry can also impact your costs significantly. Evaluating your specific business risks, along with the type of liability insurance you need, will provide a clearer picture of the financial implications.

| Insurance Type | Average Annual Premium | Coverage Limit |

|---|---|---|

| General Liability | $500 – $3,000 | $1 million |

| Professional Liability | $300 – $1,500 | $1 million |

| Product Liability | $500 – $7,500 | $1 million |

| Commercial Auto Insurance | $1,200 – $2,400 | $1 million |

Understanding these costs is crucial for budgeting your business expenses effectively. Additionally, you should also consider any deductibles associated with your policy. A higher deductible will reduce your premium but increase your out-of-pocket expenses in the event of a claim. It’s vital to strike a balance between manageable premiums and potential claim costs, so weigh your options carefully.

Factors Influencing Insurance Premiums

- Business type and risk exposure

- Coverage limits and deductibles

- Claims history and frequency

- Location and regulatory environment

- Overall credit score and financial stability

- Industry-specific factors

In conclusion, when investigating how to navigate the costs associated with liability insurance, remember to analyze all the influencing factors thoroughly. By taking the time to assess your business’s specific needs and risks, you can make informed decisions that ensure proper protection while managing costs effectively.

Actionable Tips For Managing Your Liability Insurance Policy

Understanding how to effectively manage your liability insurance policy is crucial for ensuring adequate protection. This involves staying informed about the terms and coverage options available to you. Regularly reviewing your policy is an essential step in identifying areas for improvement or necessary alterations in coverage based on changing needs. Furthermore, keeping open communication with your insurance provider can help clarify any uncertainties regarding your policy.

How to document incidents and file claims accurately is another fundamental aspect of managing your insurance. Having a clear process in place will save you time and reduce stress if you need to make a claim. Documenting any incidents immediately as they occur allows for a smoother claims process, ensuring you have all the necessary details on hand when you need them.

| Insurance Aspect | Action Item | Frequency |

|---|---|---|

| Policy Review | Review coverage details | Annually |

| Documentation | Log incidents and claims | As needed |

| Communication | Contact provider with questions | Quarterly |

| Premium Payments | Check payment methods | Monthly |

Additionally, it’s vital to be proactive about understanding any changes in laws or regulations that may impact your liability coverage. This aspect can sometimes be overlooked, but staying alert to these changes ensures that you are informed and prepared for any necessary adjustments to your policy. Regularly educating yourself about the liability insurance landscape can also help you make better-informed decisions regarding your coverage.

Practical Tips For Maintaining Coverage

- Set reminders for policy reviews and renewals.

- Keep all documents related to incidents organized for easy access.

- Maintain an open line of communication with your insurance agent.

- Review your coverage limits regularly to ensure they meet your needs.

- Stay informed about changes in legislation that may affect your insurance.

- Evaluate your current insurance company’s performance periodically.

- Consider potential discounts for bundling policies or claims-free years.